Is housing at the bubble in Toronto real estate?

With the rapid rise in the housing price this year, many of my clients ask me if the Toronto housing market is at the bubble? Today, I would like to share with you some of my thoughts on the market.

First of all, let's get familiar with the Price to Rent Ratio concept, the sale/rent ratio. The Price to Rent Ratio is often used as an indicator to measure whether the housing market is fairly valued or if there is any bubble. The price of rent can provide an essential insight into whether the housing price is justifiable.

Due to the significant differences in the housing market across Great Toronto Areas, we shall only investigate each subregion. For today, we will look at the freehold real estate market in Markham. In addition, because of the considerable price variance for different types of dwellings, I will choose the more representative 4-bedroom, double-garage housing, and 3-bedroom, single-garage, semi-detached/town housing segment for the analysis.

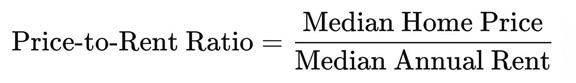

Markham 4 bedrooms double garage detached house:

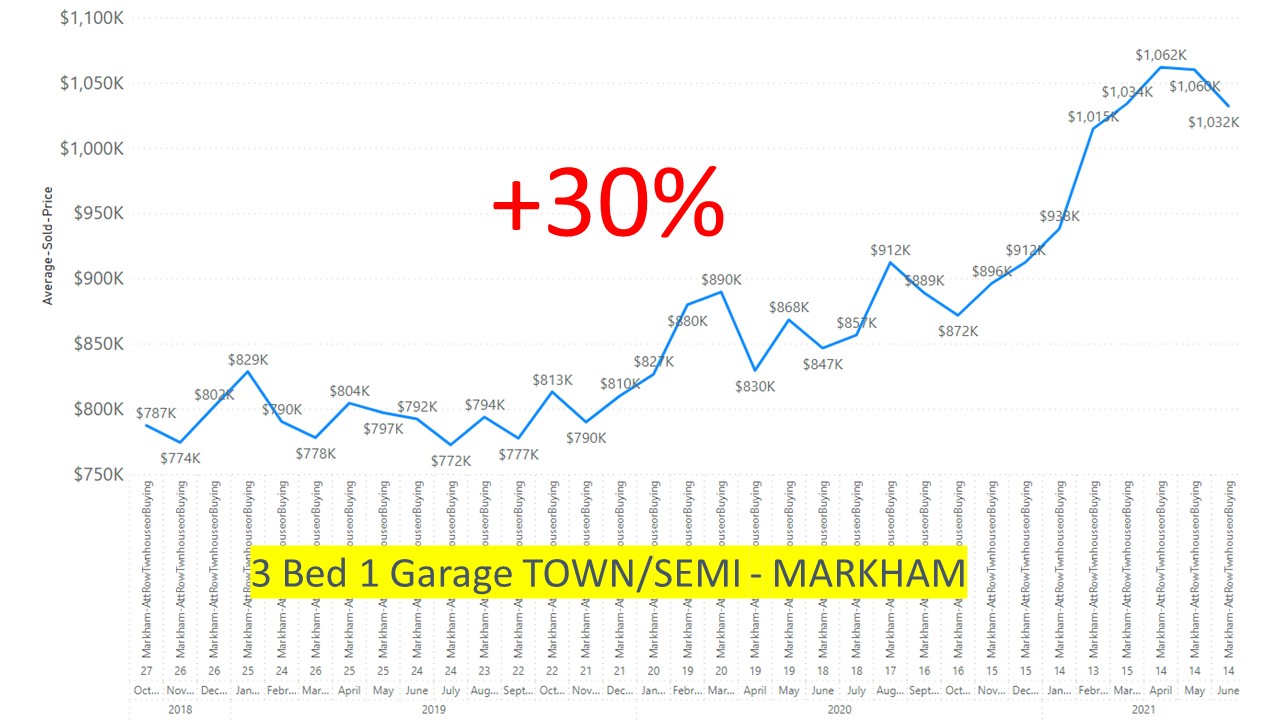

The chart below shows that the average price of houses sold has increased by 35% in the past two years.

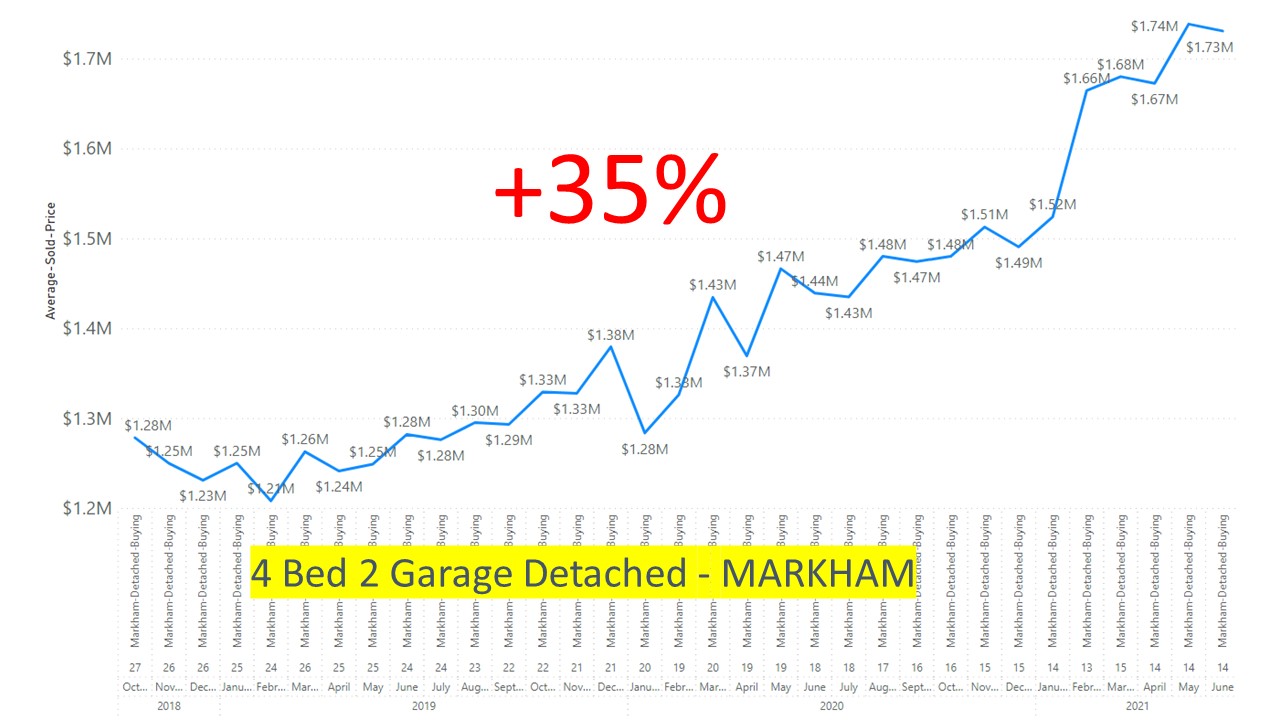

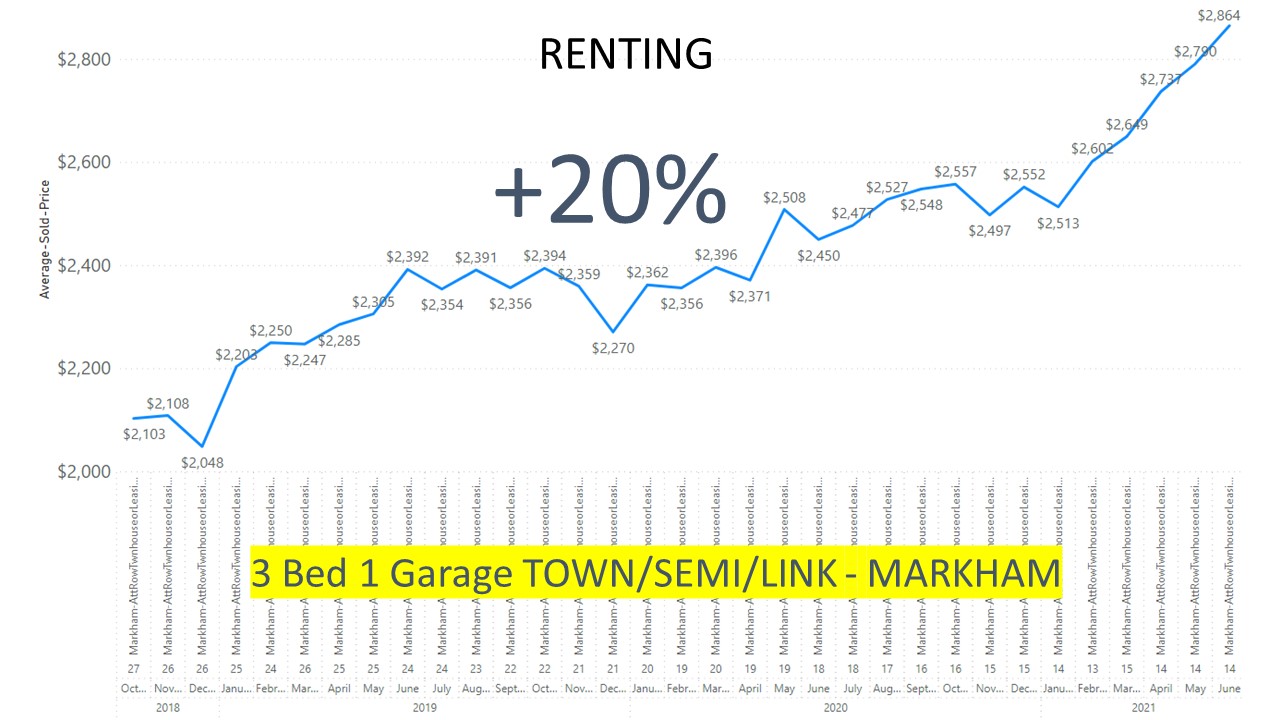

From June 2019 to the present, the average rental price has also increased by 34% year on year.

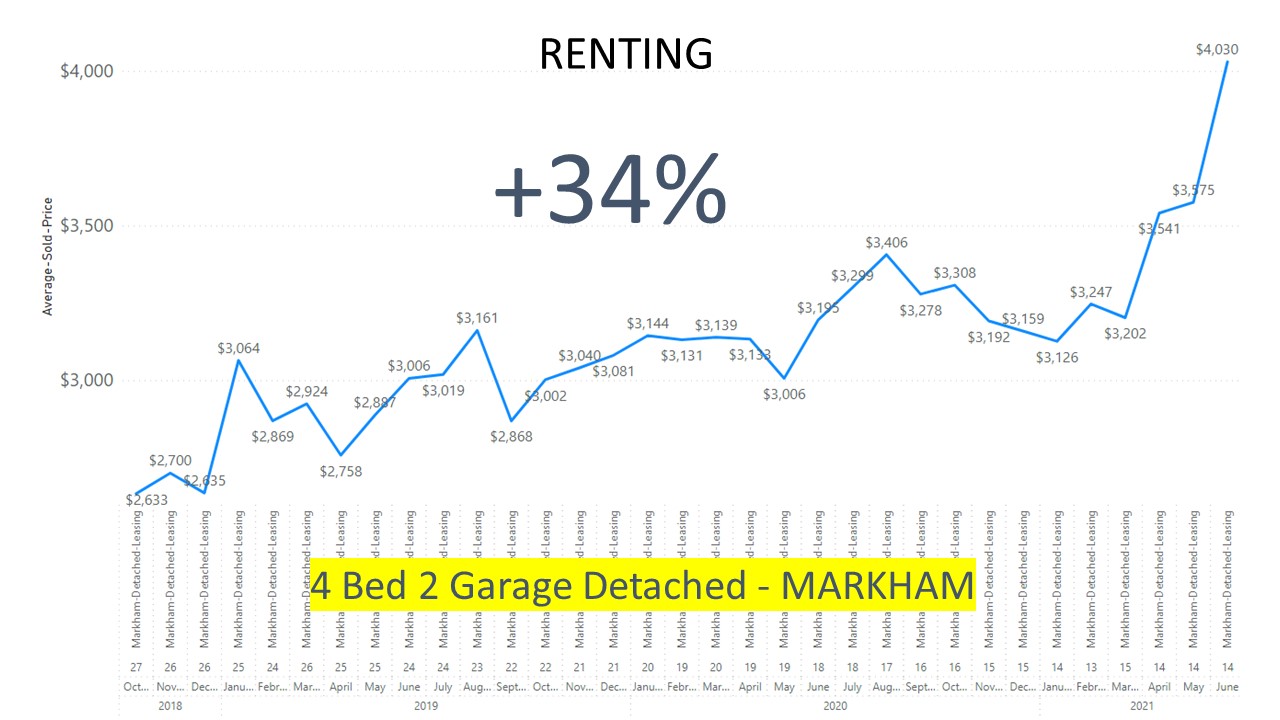

Referring to the Toronto Real Estate Board data, the median rent for a 4-bedroom double garage houses in Markham in June 2021 is 3,600, and the median house sales price is 1.69 million. Based on the Price to Rent formula, we get 39.

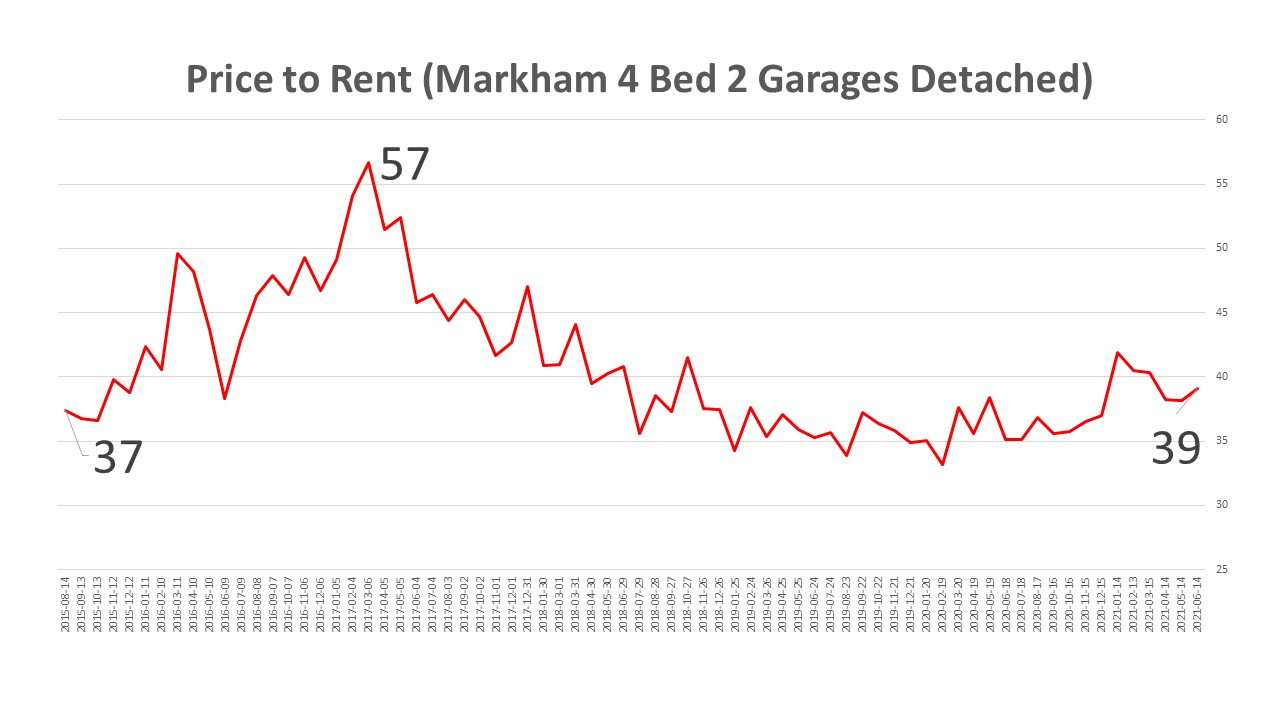

The below chart demonstrates the market situation for the past six years. You can see that in early 2017, before the rollout of the foreign buyer tax, we experienced a housing bubble in which the Sales to Rent ratio reached as high as 57. However, today the ratio is below 40.

Markham Three bedroom single garage semi-detached and townhouse:

From the chart below, we can see that housing prices have risen, with fluctuations from June 2019 to the present. The average price of town and semi-detached houses has increased by 30% compared with two years ago.

The chart below shows the trend of rents. From June 2019 to the present, the average rent price has risen by 20%.

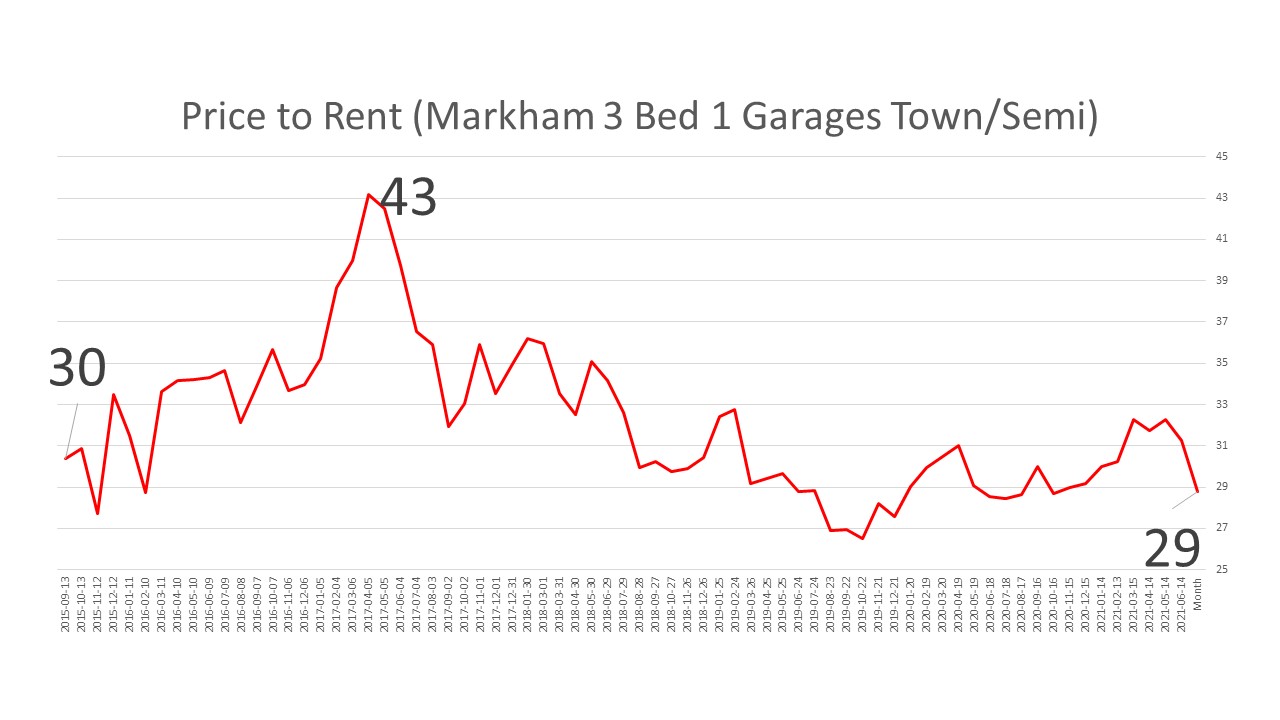

Through the Price to Rent Ratio, we can see that at the peak of the bubble in early 2017, the ratio reached 43. But today, the ratio is around 30.

In summary, we see both Freehold house prices and rents are rising in a similar proportion. Hence the current housing price is fair. If you believe there is no bubble in the Markham Freehold housing market in 2015, then based on this sale to rent ratio, there is no bubble at present. If you want to find Sales to Rent Ratio in some world most expensive cities, Global Property Guide website published an article in early 2018 which can be a good reference.

Today we studied the freehold market in Markham. So how about other parts of the Great Toronto Area? Will the rent go down post the pandemic? How about the condo market? What is the future trend of the housing market in Toronto? If you want to learn more, you can contact Toronto Real Estate Agent Alan Zheng at 647-877-9311.

- 183 Willowdale Ave

Toronto, ON, M2N 4Y9, Canada - 647-877-9311

- alan@mycanadahome.ca

- www.mycanadahome.com